Medically Necessary Panel Hosted by ProPublica

Holding Health Insurance Companies Accountable

March 28, 2023

Senior Director of Policy and Strategy Mona Shah joined “Medically Necessary,” a ProPublica virtual discussion moderated by T. Christian Miller, ProPublica senior editor, to discuss how health insurance policies are crafted, patients’ rights, and how patients can advocate for a fairer, more transparent health care system.

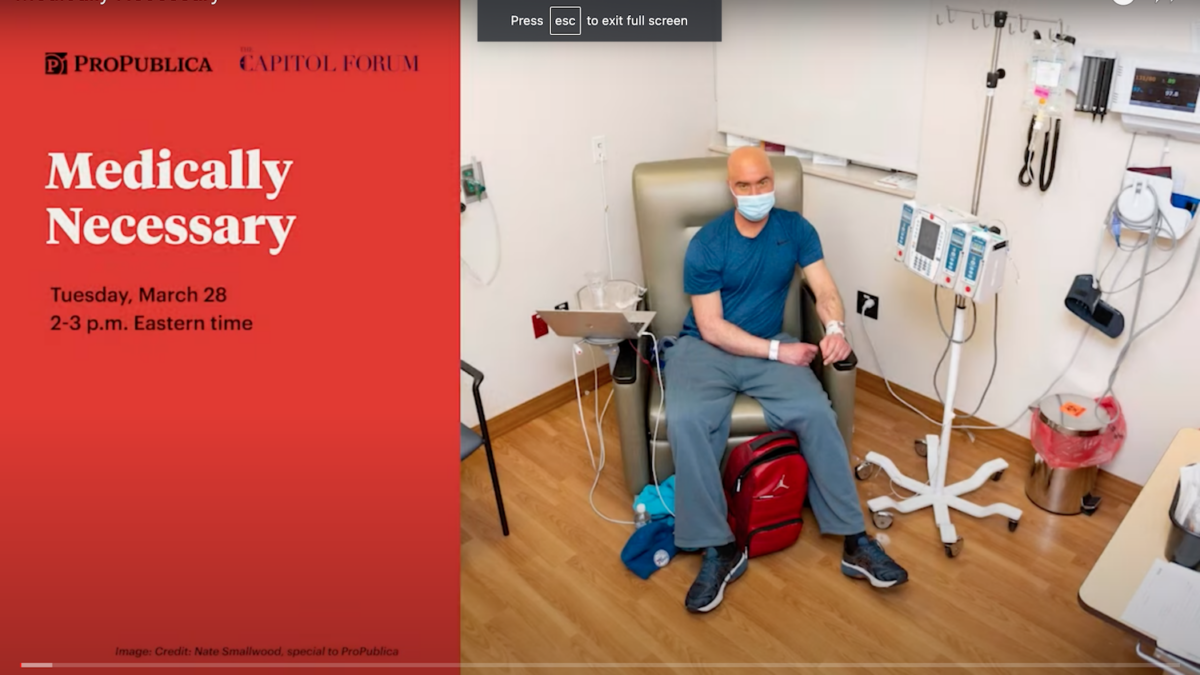

The event, which featured reporters and health care experts like Mona, served as a follow up to an investigation by ProPublica and Capitol Forum, which has resulted in several exposés, including: “UnitedHealthcare Tried to Deny Coverage to a Chronically Ill Patient. He Fought Back, Exposing the Insurer’s Inner Workings” and “How Cigna Saves Millions by Having Its Doctors Reject Claims Without Reading Them.”

Their findings revealed how Cigna, one of the largest health insurers in the United States, “built a system that allows its doctors to swiftly reject a claim on medical grounds without opening the patient file, leaving patients with unexpected bills. Using this method, one Cigna doctor single-handedly rejected 60,000 claims in a single month,” according to ProPublica.

During Mona’s portion of the panel, the group discussed patients’ rights, navigating the complexities of the health care system, potential ways to fix the broken denials system, and how everyday people can help to fix the system.

In particular, Mona was asked to speak to the policies currently in place that serve to protect patients, as well as potential policy solutions that can improve the regulation of insurance companies.

Mona established context for the discussion by mentioning a 2023 study by the Kaiser Family Foundation, which found that patients appealed less than two-tenths of 1 percent of denied in-network claims.

“So certainly, one opportunity, is creating awareness for consumers that they have a right to actually file a complaint and also appeal their denial,” Mona said.

Mona went on to note that the Affordable Care Act established consumer assistance programs to help individuals know their rights and advocate for themselves. Individuals can take advantage of these protection programs for assistance.

”We talk about how overwhelming it can be, how a lot of people don’t have the time and resources to fight these things,” Mona said.

“Also, if you have a private or Marketplace plan you can file a complaint with your state insurance regulatory body. Usually that’s the department of insurance or [the state’s] insurance commissioners’ officers,” Mona said.

Mona went on to explain that for areas with a state-based marketplace, you can file a complaint directly with the state’s marketplace. For people who use Medicaid, complaints may be filed with the state Medicaid plan. Finally, patients can leverage their state’s attorney general, who is oftentimes in charge of policies related to mental health.

“There are a lot of different channels that individuals can use at the moment to file the complaints,” Mona said. “The more complaints that are heard, the more likely there’s going to be some action.”

Invited speakers included:

- T. Christian Miller, ProPublica senior editor (moderator)

- Dr. David Rubin, professor and chief of gastroenterology at the University of Chicago Medicine

- Maya Miller, ProPublica engagement reporter

- Mona Shah, senior director of policy and strategy at Community Catalyst

- Patrick Rucker, Capitol Forum reporter

- Ron Howrigon, former Cigna executive and current president of Fulcrum Strategies, a health care consulting firm specializing in payer contract negotiation