Sick Profits: How Health Care Corporations Profit from Tax Breaks While Patients Pay the Price

Authors:

Miriam Straus, Policy Adviser, Community Catalyst

William Rice, Senior Writer, Americans for Tax Fairness (ATF)

Higher prices, denied care and substandard services – this is what our communities are facing while profits soar at seven of America’s biggest health care corporations.

A report from Community Catalyst and Americans for Tax Fairness, Sick Profits, reveals how major health care corporations are putting profits over people — benefiting from billions in tax breaks while driving up costs, denying care, and delivering substandard services.

Since the enactment of the 2017 Trump-GOP tax law—which Republicans just succeeded in extending and expanding many of its worst provisions—seven of America’s largest health care corporations — including insurers, hospital chains, and CVS Health — have dodged over $34 billion in taxes.

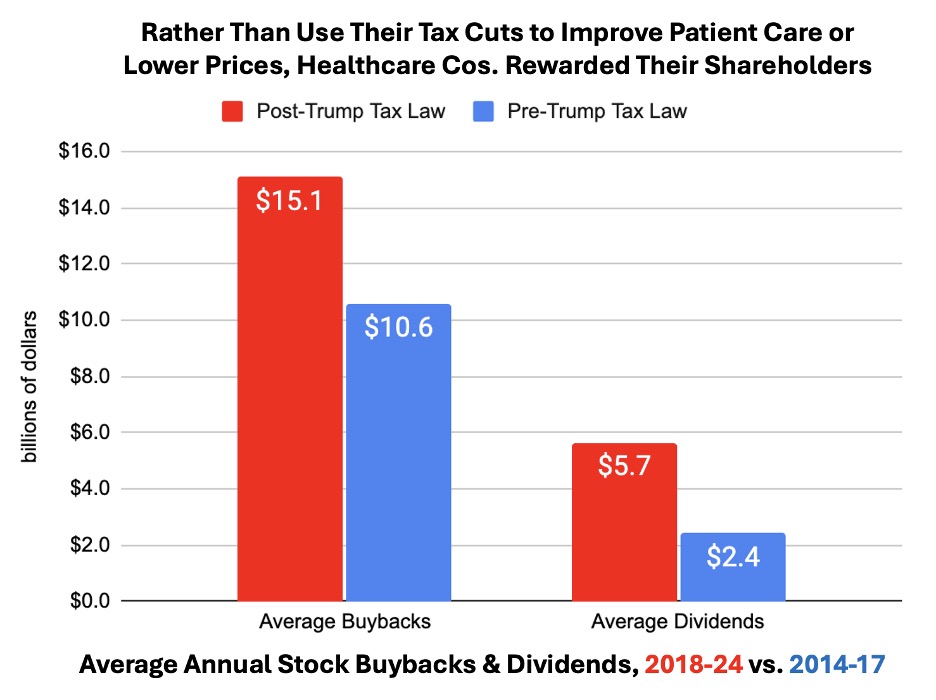

Instead of using their tax savings to lower health costs for communities or improve quality of care, these companies boosted the salaries of top executives and increased shareholder payouts. All the while, patients suffered higher costs, diminished services, and increasing insurance denials.

To make matters worse, the Republicans’ so-called “big, beautiful bill” that makes the 2017 tax cuts permanent, will also terminate coverage for nearly 15 million people, making it even more difficult for people to receive affordable, quality care, and pushing more families and individuals into crushing medical debt.

Key findings include:

- Tax windfalls: Companies like Elevance, Centene, Humana, HCA, and CVS Health pocketed billions through lowered corporate tax rates and loopholes.

- Insurance denials: Insurers are denying increasing numbers of prior authorization requests, particularly in Medicare Advantage plans, which can delay or deny necessary care for older adults. Insurance denials also appear to be rising across the board, which can disrupt treatment, prevent access to lifesaving care, and increase medical debt – all while insurance companies bring in higher profits by paying out less in claims.

- Understaffed and unsafe health facilities: Hospital and health center owners like HCA and Universal Health Services have boosted stock buybacks and dividends instead of investing in patient care, leading to reduced staffing and patient safety concerns.

- Private equity harms: Prospect Medical Holdings, controlled by private equity, extracted hundreds of millions in dividends while its hospitals deteriorated and ultimately shuttered, leaving thousands of health care workers unemployed and putting communities at risk.

The report underscores a systemic pattern: corporate greed, abuse of our tax code and harm to patients go hand in hand. The same companies exploiting tax loopholes are also driving policies and practices that put shareholder profits ahead of community health and well-being.

Voters Want Lower Costs – Not Corporate Giveaways

Polling from Community Catalyst shows that voters across the political spectrum are demanding bold action to lower health care costs, address medical debt, and hold health care corporations accountable.

- 78% of voters support a greater government role in lowering costs. Yet corporate giants are using tax loopholes and regulatory gaps to enrich executives and shareholders while patients face rising costs, denied care, and worsening outcomes.

- A majority of voters distrust health insurance companies (62% distrust) and hospitals (54% distrust) to keep prices fair on their own. Without reform to our tax code, these companies will only continue to exploit our communities by denying our care, cutting staff, and inflating prices while dodging taxes.

The vast majority of voters (73%) want the health care system to be treated as a public good — not as a vehicle for profit. Voters are demanding better – and it’s time for Congress to deliver.

We Need Action That Puts People Over Profit

These findings highlight the need for federal action that puts people over profits. Without reform, unchecked corporate power will continue to fuel the crisis of affordability, inequity, and harm in our health system. Congress must act now to:

- Close corporate tax loopholes and end special tax breaks that fatten the bottom lines of health care companies and have increased profits at the expense of patients.

- Raise the corporate tax rate so huge health care companies are paying their fair share of taxes.

- Strengthen oversight to ensure health care corporations serve people first—not profits.

Acknowledgments

We would like to thank and acknowledge authors Miriam Straus, Policy Advisor at Community Catalyst, and William Rice, Senior Writer at ATF; researchers Zachary Tashman, Senior Research and Policy Associate at ATF, and Elina Bhagwat, Policy Associate at Community Catalyst; and editors Colin Reusch, Director of Policy at Community Catalyst, and William Rice for their contributions to this report and analysis.