The Future of Tax Reform: Centering Health Justice Priorities

Far too much of the health care industry puts profits above people, with a large assist from the tax code. The unfettered, profit-driven corporate evolution of health care is behind harmful trends that are raising costs and putting essential care out of reach, especially for people with low-incomes, communities of color, and immigrants. This is seen most clearly when we look at the way many non-profit hospitals contribute to the medical debt crisis, as well as the rise of private equity in health care.

That is why health justice advocates have a lot at stake in the tax fight. Whether or not people in the Medicaid coverage gap finally get a chance at coverage, whether or not ACA plans are affordable, whether or not non-profit hospitals will be held accountable to community benefit standards, and whether or not private equity will continue to have free reign to extract from our health system in harmful ways are all at stake.

Community Catalyst is proud to join more than 100 national multi-issue organizations representing tens of millions of people from all 50 states and the U.S. territories to call on Congress to pass a bold set of changes to the tax code – including changes that would increase corporate taxes to advance health and economic justice priorities – when several parts of the 2017 Trump tax bill expire next year.

Making sure the wealthiest individuals and corporations pay their fair share in taxes is not just an economic issue, it is a health justice issue too.

The groups write that Congress should use the expiration of the Trump tax bill to accomplish three important goals:

- Make the tax code fairer: The very rich and large corporations pay a far lower percentage of their income in taxes than they used to, as a result of Trump and Bush era tax cuts. Many income tax breaks disproportionately benefit white and wealthy taxpayers, reinforcing racial disparities in economic opportunity. This is not only unfair; it is bad for our nation’s overall health and economic well-being. Overwhelming evidence shows that inequality, economic instability, and poverty lead to a range of poor health outcomes; a tax code that entrenches and even exacerbates these economic inequalities is counterproductive to a healthy society, and Community Catalyst’s vision of health as a right for all. The rich and big corporations should pay a higher share of their income in taxes than they would if the Trump tax cuts were simply allowed to expire after 2025. Additionally, as an economic and health investment to promote economic wellbeing, essential assistance should be reinstated for children and families with low or moderate income or wealth, as well as for families who bear the brunt of health inequity due to structural racism, classism and other forms of oppression that have limited economic mobility.

- Generate more tax revenue: Before the Bush tax cuts, the U.S. tax code was generating more than 20% of GDP in revenue. Last year, it was 16.5%. That’s trillions of dollars in lost revenue that could advance vital health and economic justice priorities, including the Enhanced Advanced Premium Tax Credit, more generous Medicaid and CHIP benefits, as well as investments in community and preventive health. The federal tax code should generate more revenue than it would if the Trump tax bill provisions were allowed to expire after 2025.

- Support faster and more inclusive economic growth: The Trump tax bill relied on the trickle-down theory that tax cuts for the rich and big corporations would produce faster economic growth and gains for everyone. That theory has been proven false (again). Instead, tax loopholes have encouraged powerful corporate actors, such as private equity firms, to infect nearly all aspects of our health care system. The result is worse, more expensive, and harder-to-find health care. The 2025 tax fight is an opportunity to reform the code. Tax reform should disincentivize conduct by large corporations that prioritizes profits over people.

The letter comes on the heels of a Congressional Budget Office projection that renewing the individual and estate tax cuts in the Trump law alone would cost the country $4.6 trillion. In their letter, the coalition calls the Trump tax bill a “failure on its own terms,” noting that the bill both failed to deliver the promised boost in wages for workers and also failed to “pay for itself.” Instead, it compounded the injustices of previous rounds of tax reform, which have skewed the tax code towards the wealthy and significantly eroded tax revenues that would benefit people and communities.

Changing the tax code will allow us to invest in critical health programs back into communities – which is what people want and need. We are thrilled to join this coalition to bring the voices of people from across the country demanding change to the halls of Congress.

You can read the letter to congressional leaders and view the list of the organizations that signed on here.

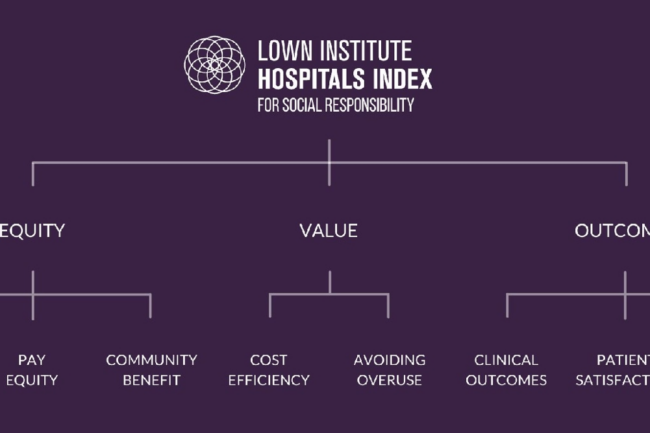

Add your name to hold non-profit hospitals accountable to their communities: Sign our petition

Related Resources

Community Catalyst Joins 100+ Multi-Issue Groups to Urge Congress to Center Health Justice Priorities in Overhaul of the U.S. Tax Code in 2025

NEW POLLING: Voters Want Policymakers To Do More To Address Health and Economic Justice; Make Health Care More Affordable

Non-Profit Hospitals and the Medical Debt Crisis in America

Essential Health Benefits: Gaps and Inconsistencies